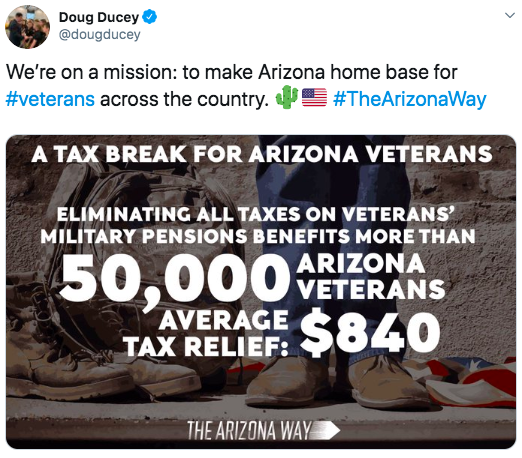

Phoenix, Arizona - More than 600,000 veterans call Arizona home - and Governor Ducey is working to welcome even more. During his State of the State Address, Governor Ducey said:

We have a goal: To make Arizona home base for veterans everywhere in the country. These women and men make our state stronger. To all our veterans, everywhere, from California to New York State, Arizona wants you. All of you. You’ve put our country first; now with this budget, Arizona will put you first.

To help accomplish this goal, Governor Ducey’s Fiscal Year 2021 Executive Budget eliminates all state income taxes on Arizona’s veterans’ military pensions.

Currently, Arizona provides an exemption from state Individual Income Tax for the first $3,500 in military retirement pay received by a retired service member.

The Governor’s balanced budget provides $45 million to fully exempt military pension pay from income tax, saving the average Arizona veteran $840 annually. The exemption will take effect in tax year 2020 and benefit more than 50,000 veterans in Arizona.

Additionally, Representative Joanne Osborne introduced H.B. 2288, offering licensing fee waivers for military spouses. Through H.B. 2288, agencies will waive the fee charged for an initial license for active duty military and their spouse as well as veterans. It applies to individuals who are applying for a specific license in Arizona for the first time. The bill passed the House last week and is heading to the Senate.