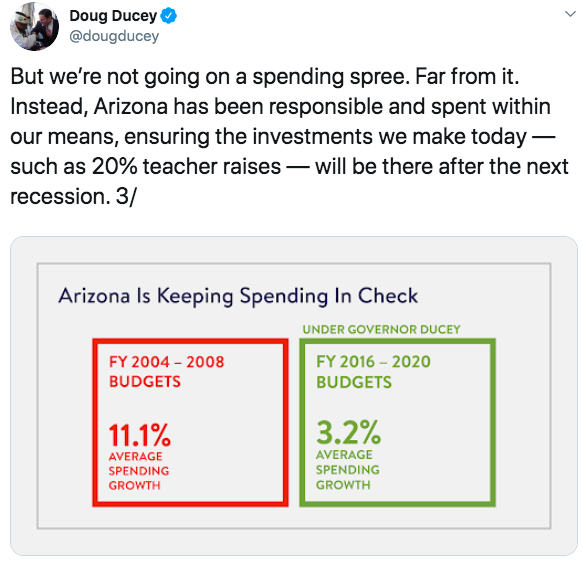

Phoenix, Arizona - This year, Arizona’s fiscally conservative, balanced budget invested in the things that matter, such as education, public safety, infrastructure and more, while preparing for Arizona’s future.

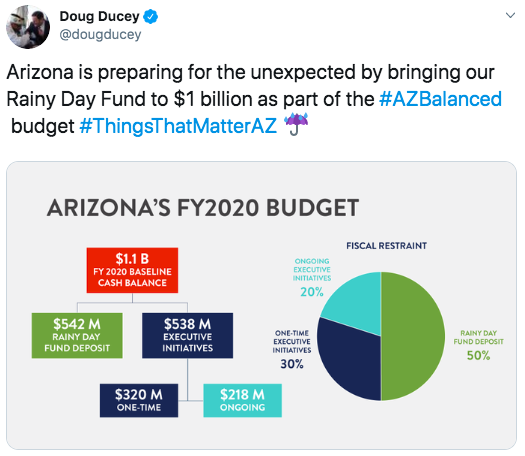

Arizona’s balanced budget added $542 million to Arizona’s Rainy Day Fund, bringing it to a record $1 billion and helping better protect Arizona’s investments during the next economic downturn. The budget also paid off $190 million in state debt, producing an ongoing savings of $74 million annually through reduced debt payments and interest costs.

The state’s forward-thinking financial decisions did not go unnoticed. In November, Moody’s Investors Service upgraded Arizona’s credit rating to Aa1, the highest rating the state has ever received. The upgrade recognizes Arizona’s continued strong economic growth as well as its efforts to balance the budget, reduce debt and boost the Rainy Day Fund to record levels. The ratings boost makes Arizona the only state to have received two ratings upgrades from Moody’s in the past five years.

Arizona was also ranked ninth on Kiplinger’s list of the top tax-friendly states. This year’s budget built on the tax relief passed as part of President Trump’s Tax Cuts and Jobs Act to make Arizona’s code simpler, flatter and more fair. The revenue neutral tax reforms—the most significant of the past 30 years—prioritized middle and low-income earners, increasing Arizona’s standard deductions to $12,000 for individual filers and $24,000 for married filers. For the first time in Arizona the state standard deduction matches the federal standard deduction, representing a significant simplification of the tax code.

Families also will benefit from a new $100 child tax credit, as will nonprofits and charities thanks to a new charitable tax deduction that encourages donations to organizations that help those most in need. For the median income tax filer, this tax reform means annual relief of roughly $135 after conformity.